How is the Minimum Monthly Repayment calculated - Equated Monthly Instalment (EMI)

From our calculator's Instructions and Tips

The Minimum Monthly Repayment payable to the bank (or any other financial institution) is inclusive of the loan interest accrued during the previous month and part of the principal to be repaid. The proportion of interest and principal for each instalment depends on the interest rate and the loan term duration. The interest component of the monthly repayment would be larger during the initial months and gradually reduce with each payment. At the same time, the principal component of the repayment will gradually increase so that every monthly repayment remains the same for the entire duration of the loan.

Nevertheless, if you chose a variable rate in your home loan agreement and the interest rate changes, then the bank will likely recalculate your minimum monthly repayment according to the new interest rate.

Depending on the conditions of the agreement with your bank, you may be able to make extra repayments on top of the Minimum Monthly Repayment. By making extra repayments, you reduce the principal owing, hence reducing the duration of the loan and the overall interest paid. In this case you are on a variable payment plan. If your agreement does not allow you to pay more than the Minimum Monthly Repayment, then it’s called Equated Monthly Instalment (EMI).

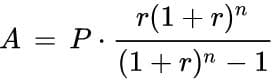

The mathematical formula to calculate the Minimum Monthly Repayments (or Equated Monthly Instalment) is:

where:

- A is the periodic amortization payment,

- P is the principal amount borrowed,

- r is the annual interest rate divided by 100 and divided by 12 in case of monthly repayments (if rate of interest is 4.5% per annum, then r = 4.5/100/12=0.0035)

- n is the total number of payments (for a 30-year loan with monthly payments n = 30 × 12 = 360),

Our mortgage calculator does all the tedious calculations for you. In the blink of an eye it generates visual charts, displaying payment schedules and break-down of the payments. It can also generate a comparison table which compares different loan offers detailing amounts, interests and terms.

Download the Amortization Schedule - Export csv

Our calculator allows you to export and download tables of repayment in format csv directly on your computer. You can therefore use Excel to perform your own data analysis and charting.

It also allows you to export a csv of your comparison table, including your banks’ offers and the different scenarios you analysed. Its’ a quick and easy way to keep a record of your calculations and to share them with other people.